Market Pulse / Bottoms up

23/08/2016

Investors breathed a sigh of relief as first half results were by and large better than expected

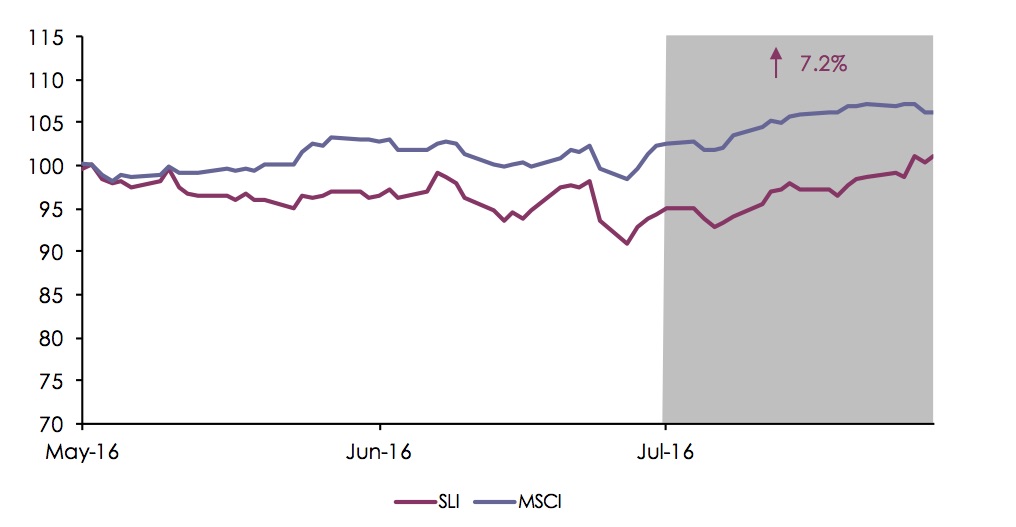

The Savigny Luxury index (“SLI”) staged a relief rally this month, gaining over 7 percent whilst the MSCI World Index (“MSCI”) gained almost 4 percent. Better-than-expected first half results took some of the sting out of the sector’s most severe correction in seven years.

Read more