24/02/2015

Sector review

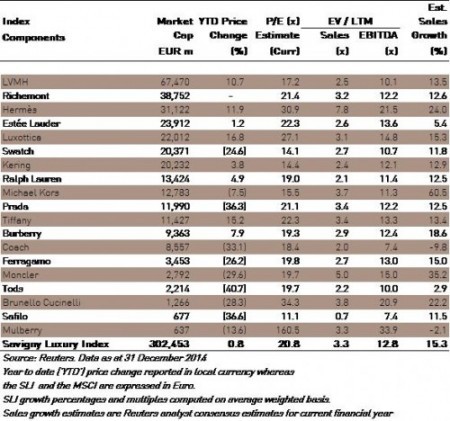

The Savigny Luxury Index lurched from crisis to crisis throughout the year, ending up bruised but not battered at the same level as the beginning of 2014. This was in sharp contrast to the MSCI World Index (‘MSCI’), which gained 16 percent over 2014. It has been a tough year for the luxury sector, which has been hammered by the slowdown of China, unrest in the Ukraine, protests in Hong Kong and currency headwinds. These macroeconomic and geopolitical issues underlined yet again the importance of China and of tourism and travel retail to the luxury sector.

Savigny Luxury Index performance Jan 2014 to date

The year started on the back foot with worrying news coming out of China and an escalating political crisis in the Ukraine. Slower economic growth along with President Xi Jinping’s crackdown on corruption changed the mood in China. The numbers of Chinese tourists travelling to Europe and the US also dropped, mainly because of adverse currency exchange rates. The Ukraine crisis hit Russian tourists flows hard as the rouble crashed and visa restrictions were applied.

For the first half of the year the luxury sector held its own, thanks to growth coming from the US and Japan and to the effect of re-positioning strategies. Americans have rediscovered interest in luxury products, especially the younger generations with increased wealth amongst second and third generations of Asian Americans and Latin Americans. The efforts of top brands to re-position themselves in the face of maturing Chinese consumers, who were moving away from monogrammed showiness to more subtle elegance were also beginning to pay off: notably LVMH’s repositioning of its core brand Louis Vuitton had a boosting effect on the whole sector.

The heat turned up in summer though: adverse currency movements, which had been a thorn in the side of all luxury players for a while, finally took a toll on sector results. Prada was the first to come out with a shock drop in its first quarter sales and soon the whole sector was talking about the impact of a strong euro against the dollar and yen on sales and margins.

In September, the further escalation of the “umbrella revolution” in Hong Kong brought the sector down, evidencing the importance of the area to the luxury industry as a whole. It is estimated that Hong Kong accounts for about 10 percent of annual turnover for top brands and up to 20 percent for hard luxury brands.

Towards of the year, a string of positive results as well as a more benign currency environment injected some confidence back into the sector. European-based luxury companies are benefitting from the double positive of growth in the US market and the rise of the dollar.

For 2015, we do not foresee any aggressive expansion plans for most of the industry but rather fine-tuning of their product offering to a more complex Asian market. The traditional luxury players will need to redefine luxury as more consumers question the ubiquity of the mega-brands.

Sector Valuation

M&A activity in the sector

Companies that have changed ownership or received investment in 2014

- Da Vinci Invest, the Switzerland-based asset management company, acquired Bruno Magli, the Italian manufacturer of luxury footwear in January

- US private equity firm Blackstone took a 20 percent stake in Versace in February

- LVMH acquired a 45 percent stake in young Italian designer Marco de Vincenzo in February

- Mayhoola, an investment vehicle held by the Qatari royal family, acquired Italian menswear and suit manufacturer Forall in February

- American private equity firm TPG bought US colour cosmetics brand e.l.f. Cosmetics in February

- Sandbridge Capital, a US-based investor consortium, took a minority stake in American fashion brand Derek Lam in February

- German retailer Douglas purchased French perfume chain Nocibé in February

- US-based jewellery and watches trader Circa acquired Portero, an American online marketplace for pre-owned luxury products in March

- Fashion group Valentino acquired Pelletterie Sant’Agostino, an Italian bag manufacturer in May

- Signet Jewellers, the UK retailer of specialty jewellery and watches, succeeded in the public takeover of Zale Corporation, the US jewellery retailer in May

- Hong Kong-based jewellery group Chow Tai Fook acquired US diamond company Hearts on Fire in June

- Private equity firm Change Capital Partners acquired luxury linen brand Frette in July

- Kering bought watchmaker Ulysse Nardin in July

- Private equity firm Catterton Partners, along with the management of John Hardy Limited, has acquired the company in a management buyout in July

- Sergey Lomakin and Gierdus Pukas acquired Italian cashmere maker Malo in August

- Private equity firm Bain Capital acquired philanthropic footwear brand TOMS Shoes in August

- UK-based jewellery group Aurum acquired the online watch retailer Watch Shop in August

- Japanese conglomerate Itochu acquired a minority stake in shirt maker TM Lewin in September

- US-based department store operator Neiman Marcus acquired mytheresa.com, the German online retailer in September

- Lee Equity Partners, still presided by private equity veteran Tommy Lee, acquired Jason Wu, the US-based fashion brand in September

- Fragrance maker Coty acquired French mass make-up brand Bourjois in October

- Estée Lauder acquired luxury skincare brand Rodin Olio Lusso and announced the acquisition of high-end niche fragrance brand Le Labo in October

- The Prada group purchased historic high quality leather producer Tannerie Mégisserie Hervy in October

- Estée Lauder announced the acquisition of niche fragrance brand Editions de Parfum Frédéric Malle in November

- Richemont’s IWC acquired the world timer patents and intellectual property of watchmaker Vogard in November

- Hour Glass, the listed Singapore-based wholesaler and retailer of watches and jewellery has acquired Watches of Switzerland, the UK-based watch retailing company, in November

- L Capital, the private equity firm sponsored by LVMH, acquired the Australian swimming brand Seafolly in December

- Estée Lauder announced the acquisition of GLAMGLOW, the Hollywood skin care brand, in December