27/01/2012

A tale of two halves

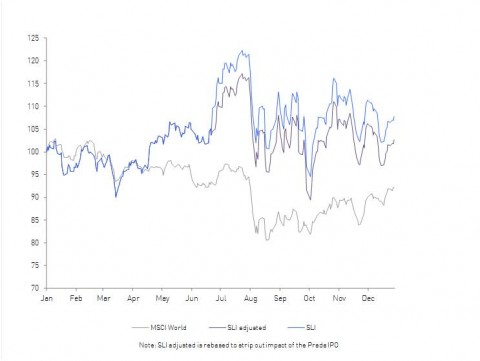

The Savigny Luxury Index (‘SLI’) outperformed the MSCI World Index (‘MSCI’) by 16 percentage points despite a string of severe beatings over the year. It gained close to 8% over the year, relative to a decline of almost 8% for the MSCI. Stripping out the effects of the Prada IPO in June, which mechanically boosted our index through the introduction of a large number of new shares, the SLI still ended the year up 3%. The past year has been a game of two halves for the SLI. The first half, with the exception of the Japan earthquake, was a period of relative stability and growth with our index significantly outperforming the overall market. In the second half however all hell broke loose in a period of uncertainty and strong volatility.

Savigny Luxury Index performance January 2011 to date

Chinese voracity for luxury fuels growth in first half

Driven down at first by profit-taking in January, the SLI evolved in line with the MSCI during the first quarter of 2011. The Japan earthquake in March pulled it down only momentarily before it overtook the global MSCI index mid–April, spurred on by reports of double digit sales growth across the sector. The SLI, perceived as a safe haven for investors amid the gloomy economic outlook, embarked on a steep ascent, gaining over 22% from the beginning of the year to its peak on the 25th of July (albeit including a 5-point Prada IPO effect). This compares to a decline of nearly 4% for the MSCI over the same period.

A very volatile second half despite largely positive sector newsflow

Successive serious concerns hit the equity markets during the second half of 2011. In August, markets fell sharply when the US lost its AAA credit rating and euro-zone debt issues started to materialise. In September, luxury stocks suffered a steep sell-off from hedge funds due to growing concerns over the Chinese economy slowing down. Global markets once again reacted to developments in the euro-zone debt crisis in September, November and again December, with Greece and then Italy taking centre stage.

Despite a string of fairly sharp drops both the SLI and the MSCI managed to finish the end of the year more or less at the level where they stood at the beginning of June, down a few percentage points for the second half of the year. However the graph paints quite a different picture for the two indices, with much greater volatility for our SLI. For example, during the September sell-off, the SLI tumbled down by 12% over five days but then gained back 14% six days later, whereas the MSCI lost 3% and recovered 5%. The same pattern occurred again later. In November, our SLI was down 10% over eight days and then 7% in the next five days, compared to a same-period fall and recovery of 6% down and 6% up for the MSCI. In December, the SLI dropped by over 8% over a week and then up 5% the following week, whilst at the same time the MSCI fell 2% and climbed back 3%.

This took place whilst the luxury sector continued to produce both good news and M&A activity, running counter to the general doom and gloom prevalent in global markets: LVMH reporting nine-month Asian revenues up 27%; the USA luxury market coming back to life (Burberry’s first half US sales and Tiffany’s third quarter revenues up 25% and 17% respectively, record Thanksgiving weekend retail sales); Richemont announcing a 36% increase in sales for the first half of its fiscal year; Bulgari, Brioni, Moncler and Delvaux changing hands, amongst others.

The uncertainty paradox

Overall, the luxury sector has proven resilient despite the difficult economic environment. The luxury groups have rarely been so profitable and well-managed, benefitting from worldwide platforms, efficient supply chains and global advertising campaigns. Analysts’ forecasts are bullish. Yet rarely have we felt so much uncertainty. Sector growth continues to be highly dependent on China, both on its domestic market and on Chinese buying abroad. Retailers are scared of taking up inventory across Western markets, where the sector as whole has an enormous accumulated investment in people, infrastructure, and stores. Other emerging markets (Brazil, some Southeast Asian countries and Russia) show enormous promise but don’t yet quite really add up to a significant share of the pie. The expected slowdown has not quite arrived yet, and nobody really knows how significant such a slowdown would be. Industry CEOs are keeping fingers crossed, and quietly playing with contingency plans and what-if scenarios they hope to never see.

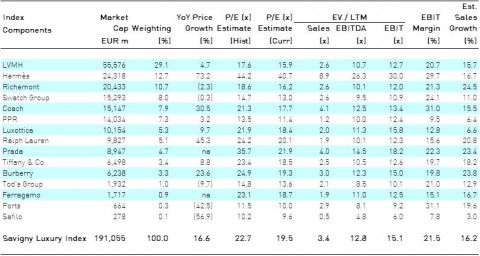

This is reflected in valuation multiples for the sector, which trade at a 25% discount compared to the end of the last year despite similar performance indicators (expected profitability and growth) as evidenced by the table overleaf.

Source: Reuters

(1) Share prices as at 30 December 2011

(2) Year-on-year price growth reported in local currency whereas the SLI and MSCI are expressed in Euro

(3) Sales growth: year-on-year change using latest annuals and consensus estimates for current year (either Dec. 11 or Mar. 12 depending on company year-end)

(4) P/E multiples: historical based on either Dec. 10 or Mar. 11 EPS; current based on Dec. 11 or Mar. 12 EPS depending on company year-end

(5) The SLI growth percentages and multiples are computed on average weighted basis

M&A activity in the sector

Companies that have changed ownership or received investment in 2011

- The management of Hobbs, the UK-based fashion retailer, acquired the company backed by 3i, the UK-based private equity firm in January

- Rive Gauche, the Russia-based perfumery and cosmetics retail chain, acquired Douglas Rivoli, the Russian retail operations from listed German perfume retailer Douglas Holding in January

- Accessory Network Group, the US-based manufacturer of handbags, acquired the American leathergoods brand Kooba in February

- TowerBrook Group Capital Partners, the US-based private equity firm, acquired the British fashion retailer Phase Eight in February

- Paris Fashion Group, the UAE-based retail group, acquired the fashion house Gianfranco Ferré in February

- LVMH acquired Nude Brands, the UK-based skincare brand in February

- Nordstrom, the US-based specialty retailer, acquired HauteLook, the American online retailer in February

- Paris Fashion Group acquired the French fashion house Louis Féraud in February

- LVMH acquired Bulgari in March

- Fung Brands, the Hong Kong-based investment vehicle funded by the Fung family and the Government of Singapore, acquired Robert Clergerie, the French footwear brand, in April

- Labelux, the Austria-based luxury group, acquired Belstaff, the heritage outerwear brand in April

- BC Partners, a UK-based private equity firm, acquired Italian department store chain Gruppo Coin in May

- PPR acquired Volcom, the Californian apparel brand in May

- Puig, the Spain-based fragrance and cosmetics group, acquired a 45% stake in the French fashion house Jean-Paul Gaultier in May

- The management of the British fashion retail chain All Saints acquired the company in an MBO in May, backed by Lion Capital, the UK-based private equity firm, and Goode Partners, the US-based private equity firm

- Qatar Luxury Group, the investment fund owned by the Emir of Qatar’s spouse, acquired Le Tanneur, the listed French leathergoods manufacturer, in May

- Labelux acquired Jimmy Choo in May

- Mubadala, the UAE-based sovereign fund, acquired cashmere brand Ballantyne in May

- EPI, the France-based luxury investment group, acquired Champagne producer Piper-Heidsieck in May

- Chantelle, the France-based lingerie company, acquired 66% of the French lingerie brand Chantal Thomass in May

- The Jones Group, the US-listed fashion group, acquired Kurt Geiger, the British footwear retailer, in June

- Eurazeo, the listed France-based private equity firm, acquired a 45% stake in Moncler, the fashion and sportswear brand in June

- A consortium of investors led by Exea Corporation (the Puig family investment vehicle), Aurica (the Spain-based private equity firm) and cosmetics veteran Hervé Lesieur, acquired French dermatological skincare company Laboratoires Dermatologiques d’Uriage in June

- China Haidan Holdings, the listed Hong Kong-based watch manufacturer and retailer, acquired Eterna, the Swiss manufacturer of watches and watch components in June

- DKSH, the Swiss-based provider of market expansion services in Asia, acquired the Swiss watchmaker Maurice Lacroix in July

- Better Capital, the listed UK private equity firm, and Royal Bank of Scotland, the listed financial services group, acquired the UK manufacturer of luxury yachts Fairline Boats in July

- Change Capital Partners, the UK-based private equity firm, acquired a majority stake in French fashion house Paule Ka in July

- E-Land Co, the South Korean fashion retailer, acquired the Italian leathergoods and accessories brand Mandarina Duck in July

- The founding family of Braccialini, the Italian leathergoods brand, and a consortium of financial investors, acquired the eponymous company in July

- AmorePacific Co, the listed South Korean personal care group, acquired the fragrance brand Annick Goutal in August

- Fung Brands acquired Delvaux, the Belgian leathergoods brand in September

- South Korean sportswear group EXR acquired the French fashion brand Jean-Charles de Castelbajac in September

- Brightwork Brand Holdings, the newly formed US-based private equity firm, acquired American leathergoods brand Ghurka in September

- Ming Fung Jewellery Group, the listed Hong Kong-based jewellery manufacturer, acquired Omas, the Italian writing instruments company in September

- Elie Tahari and Arthur Levine acquired the US-based womenswear brand Catherine Malandrino in October

- JSB International, a family-controlled investment vehicle, acquired French fashion Jean-Louis Scherrer in November

- PPR acquired Brioni in November

- Simest, the Italy-based venture capital firm, acquired 49% of Buccellati, the Italian jewellery brand in November, from one of the family shareholders. 51% of the company is still in family hands

- E-Land Co acquired the Italian leathergoods brand Coccinelle in December

Important Notice

This newsletter is distributed from time to time to clients and contacts of Savigny Partners LLP (“Savigny”) who are interested and professionally experienced in the luxury goods sector. The views and opinions expressed in this newsletter pertain to themes that are topical to the luxury goods sector as at the date of this newsletter, and are meant to stimulate open discussion between Savigny and its clients and contacts. The information in this newsletter has been compiled from sources believed to be reliable but neither Savigny, nor any of its partners, officers or employees makes any representations as to its completeness or accuracy. This newsletter is not intended to help its addressees or readers make investment decisions, nor does it purport to make recommendations regarding potential investment decisions. Savigny shall not be liable or responsible for any loss or damage caused by or arising from any reader’s reliance on information contained in this newsletter. Please note that some or all of the brands, and the companies which own brands, mentioned in this newsletter may have been and may continue to be clients of Savigny or may have a professional relationship with Savigny.